Understanding the Product Highlight Sheet (PHS)

When it comes to investing in unit trusts in Malaysia, it’s important to clearly understand what you’re putting your money into. That’s why every investor should be familiar with the Product Highlight Sheet, (PHS).

The PHS is a concise, easy-to-read document that outlines the key features of a unit trust fund. Think of it as a simplified guide—cutting through complex details and helping you decide whether a fund fits your goals, risk appetite, and expectations.

What Is a Product Highlight Sheet (PHS)?

A Product Highlight Sheet provides a summarised view of a unit trust fund, designed specifically to help investors make informed decisions before committing their money. Unlike the detailed Prospectus, the PHS is short, straightforward, and focused on answering the most important investor questions:

· What is the fund’s objective?

· Who is it suitable for?

· What does the fund invest in?

· How risky is it?

· What are the potential costs?

· How can I buy or sell units?

This makes the PHS an essential read for both first-time and experienced investors.

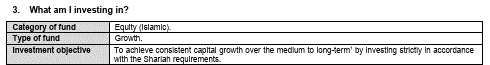

1. Fund Objective & Type

The Fund Objective explains what the fund aims to achieve, while the Fund Type shows its classification — such as Equity Fund, Islamic Fund, or Balanced Fund.

Example:

In the Hong Leong Dana Makmur PHS (as of July 2025):

· Type: Islamic Equity Fund

· Objective: “To achieve consistent capital growth over the medium to long term by investing strictly in accordance with Shariah requirements.”

This section helps investors decide if the fund’s goals align with their own financial objectives.

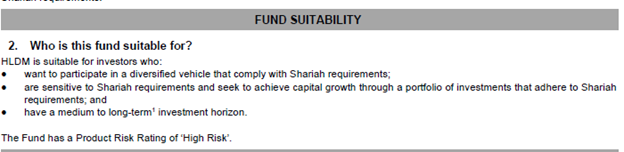

2. Fund Suitability

This section explains who the fund is meant for. It typically outlines the investor profile — conservative, moderate, or aggressive.

The Risk Rating gives you a quick sense of the fund’s risk level, helping you decide whether the potential ups and downs match your personal risk tolerance.

Example dated 10 July 2025.

3. Key Fund Features

The PHS also presents a summary of important fund characteristics, such as:

· Fund Category

· Investment Objective

· Investment Strategy

· Asset Allocation

· Performance Benchmark

· Distribution Policy

· Launch Date

Understanding these details helps you see what the fund invests in, how it intends to generate returns, and how your income may be distributed.

4. Fees & Charges

Before investing, it’s essential to understand the costs involved. The PHS will outline both one-time and recurring charges such as:

· Sales charge – one-time fee when buying units

· Annual management fee – ongoing fee for managing the fund

· Trustee fee – cost of keeping your investment secure

· Redemption charge – may apply if you sell your units too soon

· Switching fee – when you switch from one fund to another

· Transfer fee – for transferring units to another person

These fees can impact your overall returns, so reviewing this section is a must before investing.

5. Past Performance Snapshot

The PHS provides a quick summary of the fund’s historical returns and a comparison against its benchmark in recent years. This helps you gauge consistency and volatility of the fund.

However, it's important to remember the disclaimer included in every PHS:

“Past performance is not indicative of future results.”

Why the PHS Matters

The Product Highlight Sheet is a powerful tool because it:

· Presents the fund’s most important details clearly and concisely

· Helps investors decide if a fund suits their goals and risk profile

· Acts as a simplified reference before making a decision

· Saves time compared to reading the full Prospectus

· Meets regulatory requirements, ensuring transparency and fairness

Need Help Deciding?

Still unsure how to interpret the PHS or which fund suits you best? Our licensed financial consultants are ready to guide you. Click here to reach out to us!