What is DCA?

DCA is a strategy whereby an investment is done monthly, quarterly or on a schedule with a fixed amount of money into a particular investment regardless of market fluctuations.

This potentially helps investors reduce the risk of their overall investment.

Investors often attempt to time markets by applying a simple method that is buying the fund when prices are low and selling them when they’re at their highest. However, it is always difficult to predict market swings.

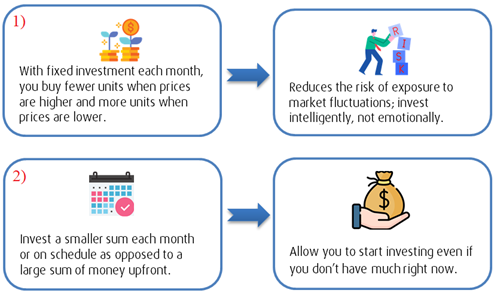

This is why DCA is a method that helps to:

- Even out the price fluctuations; and

- Potentially reduce the price you spend per unit.

The Benefits of DCA

How does DCA work?

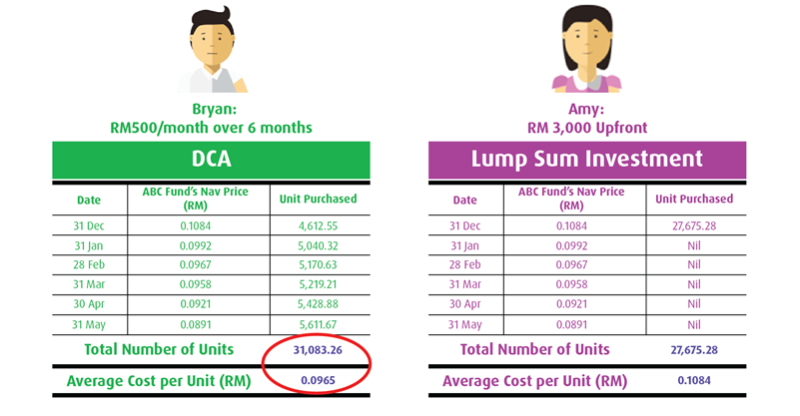

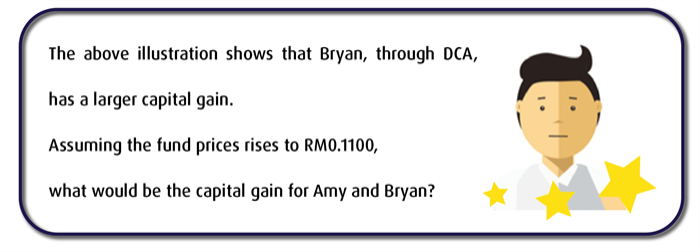

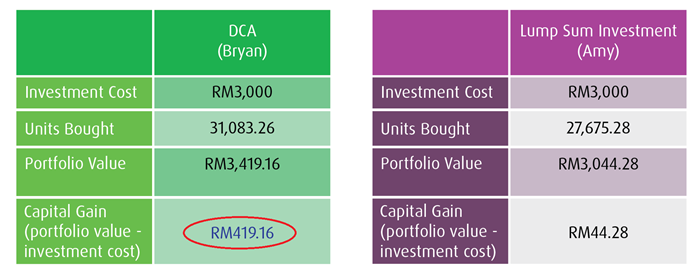

This comparison of DCA against lump sum investing will help you better understand how DCA works.

Summary

DCA is an investing strategy for investors who want a scheduled contribution into his/her investment portfolio over time. This may help to mitigate the risk of timing the market regardless of market movement.

Disclaimer:

This article has not been reviewed by the Securities Commission Malaysia. Investors are advised to read and understand the contents of the Hong Leong Master Prospectus dated 23 August 2019, First, Second and Third Supplementary Hong Leong Master Prospectus dated 18 November 2019, 27 March 2020 and 31 December 2020 respectively (the “Prospectus”) and Product Highlights Sheet (the “PHS”) before investing.

The data and content presented in this article are for information purposes only and are not a recommendation to buy or sell any securities or adopt any investment strategy. This material is not intended to be relied upon as a forecast, analysis, research, or investment advice regarding a particular investment or the markets in general, nor is it intended to predict or depict performance of any investment. The information in this article does not take account of any investor's investment objectives, particular needs or financial situation. You should consider whether an investment fits your investment objectives, particular needs and financial situation before making any investment decision.